Ind Swift Laboratories seems to have bottomed out at 22 and technically the prolonged correction from 2004 seems to have come to an end.The stock is beginning a new cycle as of now.

What does Astro say?

The stock is currently undergoing Rahu period with Jupiter sub period.

Rahu is in the second house but in Moon star. Moon is a 12th house lord for this stock. So unless Rahu moves to Sun star, we may not see much traction.Also Jupiter must come out of the retrograde period. Rahu comes to Sun star on July 13, 2015.And Jupiter becomes direct on April 09th. So post April 09th, Ind Swift may start a steady uptrend.After June 2015, Ind Swift enters the Saturn sub period. As long as Saturn is retrograde, this uptrend or sideways trend may continue. Once Saturn becomes direct on August 03rd, things could turn difficult and only when Saturn enters Mercury star on December 29, 2015, shall the uptrend resume once again.

Wednesday, February 18, 2015

Mars in Pisces along with Venus

Mars moves through Jupiter, Saturn and Mercury stars in Pisces.Pisces is the ninth house for Nifty futures and Mars is a malefic both naturally and functionally.While Venus, a natural benefic, is in her exaltation in Pisces. So how has Nifty fared in the past? Let us take a trip down memory lane to a few years...

In 2013, when Mars entered Pisces, shown in yellow highlight, there was a reversal of down trend and formation of a short term peak. When Venus joined Mars, Nifty resumed the down trend in a more pronounced manner.

We see the same trend in 2011. Nifty moves up from a sideways trend, forms a short term peak and then when Venus joins Mars, Nifty reacts down more pronouncedly.

Here is a complete reversal! Mars enters Pisces when Venus is already there, but in a retrograde fashion.So while Mars goes through Pisces at his pace, Venus retrogrades there and leaves Pisces only after Mars leaves. When retrograde Venus conjuncts with Mars in Pisces, we see a huge inversion- market shoots up consistently. Added catalyst is the presence of Uranus!

Both in 2007 and in 2002 ( added as just a flavour of a more distant past), Nifty forms a top,forms a low and then reverses to a higher high. This tells us that it is the presence of Venus in direct motion, in its exalted sign, which actually pulls the market down and causes a lower low.

Now, I admit this exercise is too simplistic. We must consider the effects of other planets also to get a more complete picture.

So fast forward to 2015...

Let us also look at the total astro chart for some more information...

What strikes us is the total benevolent long term influences amongst these many occupants of Pisces.Jupiter forming trine with Venus, Mars and Uranus.Also Uranus and Pluto squaring for the last time in our lives.Sure, Venus will pull the market down, conjunctions of Venus with Ketu and Mars with Ketu also may pull the market down, yet because of the positive influences of the long term planets, Nifty may recover.

In other words, Nifty should move up slowly, with great volatility, brought about by Mars, Venus and Ketu conjunction.

But things definitely will come to a head in March where the positivity may give way to a move towards the mean, what is called as mean reversion.So trade cautiously.Capital protection is always the first concern.

Tuesday, February 17, 2015

Crude Oil Outlook 2015

Crude seems to be in the final leg of wave c. It is expected to bottom out 9 months from now, in November 2015.Green shade represents the upmove period from 2000 to 2008 and the purple shade depicts the time period of correction from 2008 to the present period. We see that the corrective period equals the uptrend period, more or less.Since corrections take longer than up-moves, we expect the bottom for Crude to be sometime in November or early December 2015. 80 to 90 is a severe resistance zone- so right now crude is for trading and not for investing.

This also means that the current uptrend is only corrective and crude should resume its downtrend after this upmove. That ought to be c of c and may bring crude`s downward trajectory to an end.

This also means that the current uptrend is only corrective and crude should resume its downtrend after this upmove. That ought to be c of c and may bring crude`s downward trajectory to an end.

Monday, February 16, 2015

Nifty Astro Technicals Feb 16 to 20, 2015

On February 13, 2015, Mars has moved into Pisces. Here it

will move through Jupiter, Saturn and Mercury stars.

We see that Mars in Pisces will form a peak and then a down

trend starts in most cases.

On February 16, 2015, Venus ingresses into Pisces as well.

Venus in Pisces also corresponds to a peak formation and a down trend later on.

February 19, 2015, 05.17.08 am. We have a New Moon in

Aquarius. This New Moon triggers the mid-point of Uranus Pluto square. At 12.57

hours, the same day, Moon will be the closest to the Earth. This could increase

the intensity of the New Moon. New Moon is in Mars star, and Mars is in Pisces

in the star of Saturn. So we may expect more news of reforms, some of them

radical. Since Saturn and Mars are involved will it be a little bitter?

Also Rahu is in the mid-point of Jupiter Saturn formation.

So there is confusion in the minds of powers that be as to the next course of

action. While Jupiter wants to give, Saturn does not want to. And Rahu acts

exactly like Saturn. So any economic news may be taken only with a pinch of

salt.

Anyway Sun is also in the midpoint of Uranus Pluto square.

So it is something to do with Governments. My take is it will lead to more

global bullishness.

On February 22, 2015, Mars and Venus are conjunct. Market

tends to move up in the short term, after the conjunction.

On February 23, 2015, Sun squares Saturn and that generally

corresponds to a peak within 3 to 4 days and a jerky fall immediately.

So the current uptrend looks to continue till the weekend or

at best till early next week after which a short term pull back can occur.

Be on the watch out on February 19/20 also for any sudden

pull back caused by the New Moon.

Next week and into March first week we have several

important aspects coming up. My take is that volatility should increase from

here on, notwithstanding the budget.

Still expect volatility spikes. . so be careful with your trades.

Let Lord Shiva guide you all the way from this Maha Shivaratri!

Thursday, February 12, 2015

Dow Jones and Gold charts Feb 2015

We had last seen Dow Jones on November 27th 2014,which is available in this link...

http://niftyastrotechnicals.blogspot.in/2014/11/astro-technicals-of-dow-jones.html

Nothing much has changed with the Dow. We had expected the Dow to face resistance at 18000 levels.That is what happened. Dow turned down from 18000 and had gone down up to 17037 and is now attempting another go at 18000.As I write this article, Dow is at 17934.

So, how do the charts look now?

This time round, Dow may break 18000 and march towards 18650...

In the hourly, we see that Dow has broken out of the descending channel convincingly.

Look at the astro chart. Jupiter is in 22 degrees Cancer, while the Ascendant is at 25 deg Cancer. In April, Jupiter is becoming direct. So it will lord over Dow Jones. Jupiter happens to be a significator of 6 and 9th house.So generous price appreciation is to be expected. Also Rahu will move into the second house shortly. Since Rahu is in Moon star, this movement also may cause bullishness.Once the congestion in the 8th house dissipates, Dow is saet to take off. So we may expect other world markets also to follow suit.

Gold is a totally different market, altogether...

As can be seen, Gold is about to commence first wave of c..This means that Gold may go below $1000.

http://niftyastrotechnicals.blogspot.in/2014/11/astro-technicals-of-dow-jones.html

Nothing much has changed with the Dow. We had expected the Dow to face resistance at 18000 levels.That is what happened. Dow turned down from 18000 and had gone down up to 17037 and is now attempting another go at 18000.As I write this article, Dow is at 17934.

So, how do the charts look now?

This time round, Dow may break 18000 and march towards 18650...

In the hourly, we see that Dow has broken out of the descending channel convincingly.

Look at the astro chart. Jupiter is in 22 degrees Cancer, while the Ascendant is at 25 deg Cancer. In April, Jupiter is becoming direct. So it will lord over Dow Jones. Jupiter happens to be a significator of 6 and 9th house.So generous price appreciation is to be expected. Also Rahu will move into the second house shortly. Since Rahu is in Moon star, this movement also may cause bullishness.Once the congestion in the 8th house dissipates, Dow is saet to take off. So we may expect other world markets also to follow suit.

Gold is a totally different market, altogether...

As can be seen, Gold is about to commence first wave of c..This means that Gold may go below $1000.

Nifty Technicals Update Feb 12, 2015

This is an updated cycles chart.Due to the interplay between the smaller blue cycle and the longer and more powerful red cycle..(blue wants down and red wants up), Nifty is treading water at 8600- 8650 levels. Eventually the red cycle direction may prevail.Comparing with the previous red cycle and Nifty behaviour, it looks to be a more sedate rise, cycles wise, rather than spectacular and Nifty may or may not cross the previous top in one go. Actually it is academic because as a trader, I would simply hang on the coat tails of Nifty and go where she goes.Wave wise, the drop to 8400 levels was wave d and the next rise should be wave e and it may cross the previous top.

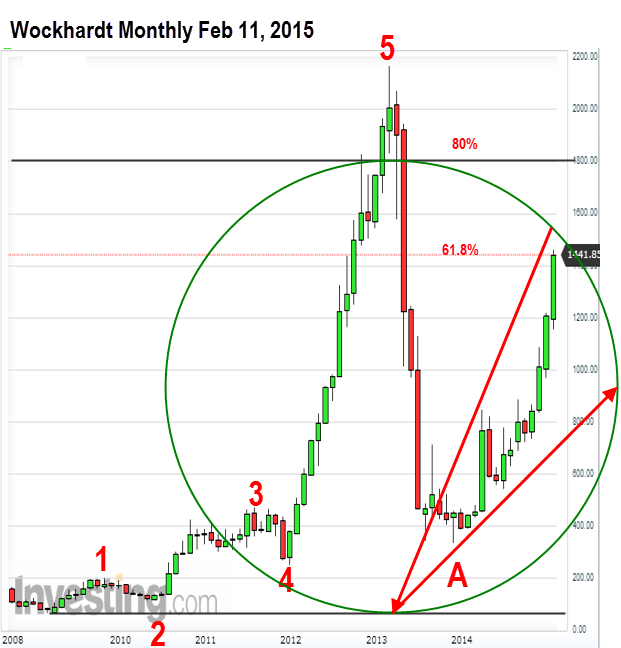

Wockhardt --Feb 11, 2015

Pictures speak louder than words. Wockhardt is in a corrective mode. Look to see if it tops out somewhere between 1600 to 1800 in the current upmove. Then wave c should begin down in a prolonged correction. So short term is up, but medium term is down..

Friends, it is extremely difficult for me to keep analysing individual stocks on specific requests. Paucity of time is the major reason. Despite mentioning this several times, I keep getting such requests!So, I intend to start an analysis section for stock specific requests, but it may not be for free.Also the service will commence only after April, 2015, when Jupiter becomes direct! If you are interested you may contact me at my mail id, tekkiesuresh@gmail.com.

Sorry, but there is no other way...

Friends, it is extremely difficult for me to keep analysing individual stocks on specific requests. Paucity of time is the major reason. Despite mentioning this several times, I keep getting such requests!So, I intend to start an analysis section for stock specific requests, but it may not be for free.Also the service will commence only after April, 2015, when Jupiter becomes direct! If you are interested you may contact me at my mail id, tekkiesuresh@gmail.com.

Sorry, but there is no other way...

LT An update Feb 11, 2015

This is an update and course correction for the views given on LT in the following post:

http://niftyastrotechnicals.blogspot.in/2015/01/astro-technicals-larsen-and-toubro.html

Let us see how LT is likely to fare in the coming days....

LT has ended its long term correction and is now in a new impulse. Currently we are close to topping out in wave 1. Some correction in wave 2 should bring the stock down. It should be an excellent buy later in the year, for a prolonged rise.

For the very short term it is a buy, but be careful of overhead resistance at 1740 levels. That should be a temporary top for a second wave reaction.

http://niftyastrotechnicals.blogspot.in/2015/01/astro-technicals-larsen-and-toubro.html

Let us see how LT is likely to fare in the coming days....

For the very short term it is a buy, but be careful of overhead resistance at 1740 levels. That should be a temporary top for a second wave reaction.

Wednesday, February 11, 2015

Ashok Leyland a technical view ( February 10, 2015)

Since the long term chart is showing that wave 3 has ended and 4 has begun, it would be prudent for investors,to use the imminent upmove on budgetary conditions to get out of Ashok Leyland for the time being. For the short term of a month or so, Ashok Leyland can be bought and possibly sold off post budget.

After the 4th wave, which may last a few months, (fewer than wave 2 because wave 2 was complex and so wave 4 could be simple) Ashok Leyland could be bought for the medium term and ride wave 5 upwards into 2016. If Ashok Leyland is available between Rs 45-50 after the budget correction, it may be a good medium term buy.

After the 4th wave, which may last a few months, (fewer than wave 2 because wave 2 was complex and so wave 4 could be simple) Ashok Leyland could be bought for the medium term and ride wave 5 upwards into 2016. If Ashok Leyland is available between Rs 45-50 after the budget correction, it may be a good medium term buy.

Subscribe to:

Comments (Atom)