Let us look at another stock, a famed multinational FMCG Company from a technical perspective..Iam referring to Hindustan Unilever Limited..

What strikes us first, is that the long term price and time seem to be squaring. Which means Hindustan Uni Lever is in a major topping out process.Not too much of upside left for the moment...

What do the waves say?

Yes, the waves also seem to confirm..we are in the 5th of a long term Elliott wave formation...Soon HUL has to start correcting.What could make HUL to correct? No idea...but something is definitely cooking.

This is how the parent is looking like....

Seems to be in 4th of fifth..Next up move may be used to exit positions from HUL.

Here is an astro analysis of HUL...

Trade harmoniously and safely!

Wednesday, October 8, 2014

Tuesday, October 7, 2014

Monday, October 6, 2014

Nifty Astro Technicals ICICI October 06 2014

We will look at another stock here, which moves in sympathy with Nifty most often...ICICI

In the monthly chart, we see ICICI completing wave 1 of a new impulse. Currently it is in wave 2..After the long term wave 2, ICICI is in for a fine upmove when bigger wave 3 starts.

Weekly chart shows the impulse divisions of wave 1 and the 38.2% retracement level for the current move. 1361 should be an important level.

Daily chart shows the down move labelling.Wave a should bottom out around 1361 levels and then an upmove of b should start. This can go up to the recent top...

30 Min chart shows further break up of the current wave c. Whatever immediate improvement we see should only be shorted. We may wait for wave c to be completed, before embarking on a positional buy.

Good luck!

In the monthly chart, we see ICICI completing wave 1 of a new impulse. Currently it is in wave 2..After the long term wave 2, ICICI is in for a fine upmove when bigger wave 3 starts.

Weekly chart shows the impulse divisions of wave 1 and the 38.2% retracement level for the current move. 1361 should be an important level.

Daily chart shows the down move labelling.Wave a should bottom out around 1361 levels and then an upmove of b should start. This can go up to the recent top...

30 Min chart shows further break up of the current wave c. Whatever immediate improvement we see should only be shorted. We may wait for wave c to be completed, before embarking on a positional buy.

Good luck!

Friday, October 3, 2014

Nifty Technicals October 07 to 10, 2014

We first look at a comparison between S&P 500 and Nifty on a monthly scale. This is just to identify how the cycles stand relative to each other...

As can be seen, the current monthly cycles of S&P 500 are earlier to that of Nifty. S&P had bottomed out earlier and may top out earlier as well. Iam not suggesting that S&P is going to top out now.It is perfectly possible that the US Index will warn us beforehand in case of a long term reversal.

Since long term planets are not sufficiently engaged with one another, Iam skeptical of projecting any long term reversal in both indices. Still this study tells us that possibly the S&P may top out first.

On another count, have a look at Dax Monthly here...

In the context of astrology, these synchronicities may only be explained if astro factors which affect all of them universally is considered. And those are Aspects. Aspects are the same whatever be the Ayanamsas considered.

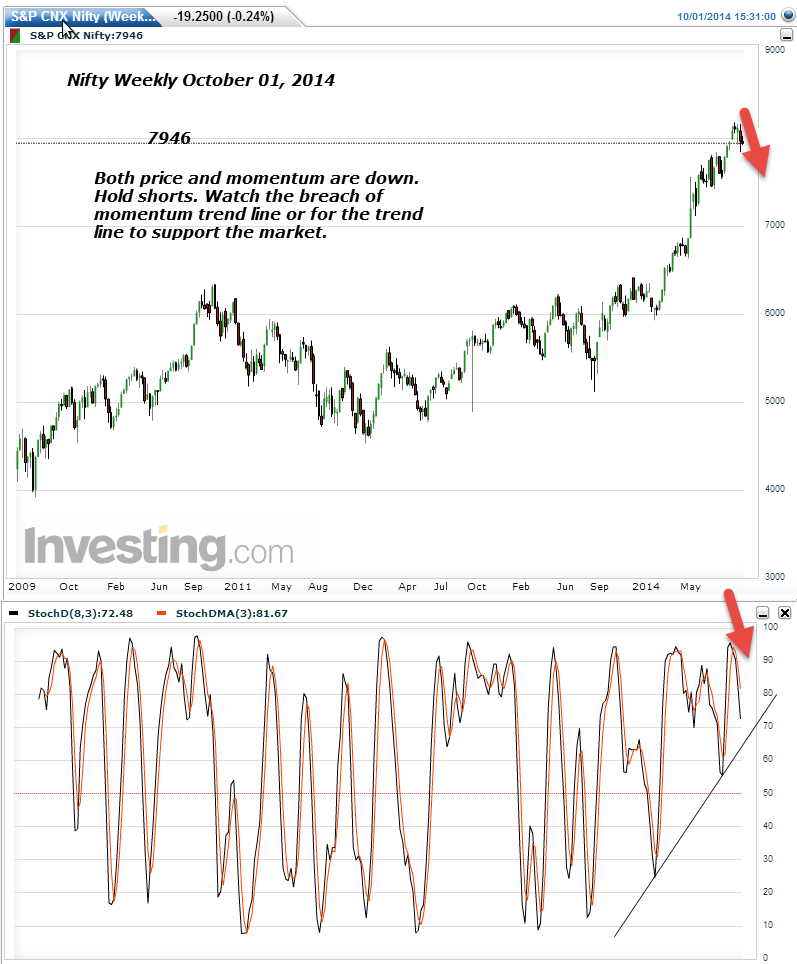

Before we get into the counts, let us look at the momentum charts..

As can be seen, the current monthly cycles of S&P 500 are earlier to that of Nifty. S&P had bottomed out earlier and may top out earlier as well. Iam not suggesting that S&P is going to top out now.It is perfectly possible that the US Index will warn us beforehand in case of a long term reversal.

Since long term planets are not sufficiently engaged with one another, Iam skeptical of projecting any long term reversal in both indices. Still this study tells us that possibly the S&P may top out first.

On another count, have a look at Dax Monthly here...

In the context of astrology, these synchronicities may only be explained if astro factors which affect all of them universally is considered. And those are Aspects. Aspects are the same whatever be the Ayanamsas considered.

Before we get into the counts, let us look at the momentum charts..

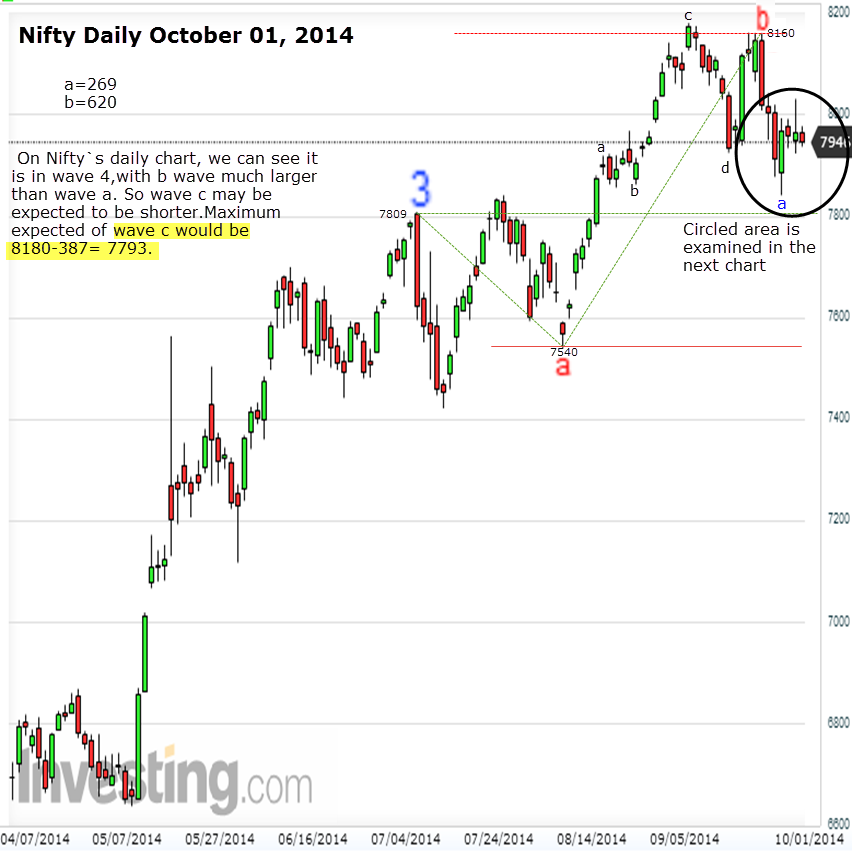

Looking at the wave counts,

Even though I had shown here three angular supports, I expect 7845 to hold or at the worst, 7785. It is highly unlikely that we may slip to 7700 and below. But then market is always supreme.

It pays to keep an eye on the 144 days average....

Finally a look at the time price square indicates that 7875 and 7843 can be important levels.

To sum up,

1. We seem to be in the final leg of wave 4

2. Weekly momentum is negative. We wait for the smaller time periods to fall in line with the weekly, before venturing to buy anything.Till the weekly bottoms out, all upward movements are safe shorts.

3.Price wise 7875 and 7843 are levels to watch.

4.Astrologically, upto October 13, we are in a very volatile period. Positional trades can be taken up after October 13th.

5. Iam yet to see evidence of a major top in the making. Larger time planets indicate this could be some months away.

6. These are just my understandings.Let me state they are not recommendations. Errors and omissions are to be expected!

In the meantime, have a great holiday and enjoy the dynamics of October!

I would love to receive feed back.Do let me know your mind.

Nifty Astro views- October 07 to 10, 2014

At last, September is over. It had been a significant month

where we were on the edges of our seats as far as trading is concerned. There

were so many views flying thick and fast, stating that we are hitting a top and

severe market declines are round the corner. Entering October, the uncertainty

has only increased. One thing is certain. The more we move away from September,

without a significant market correction, the more is the certainty that we are

in a new bull market. I continue to rely on aspects and signs primarily because

we are in a connected world and what works universally works for our markets also.

Let us start a day by day astro look from September 23

onwards and see how things look:

By 23rd September Pluto

turns direct. This is a significant signature suggesting reversals. Market

reverses downward again. So the reversal which began on September 08, is helped

by Rahu afflicting Mercury and now by Pluto becoming direct. So the negativity

looks like continuing unless something positive happens.

By September 25, Venus moves

into Virgo, her house of debilitation. So now, we have Mercury weak because it

has moved out of exaltation, Sun, not as strong, because he has moved out of

Leo and is moving to Libra, his sign of debilitation and Venus, weak, because

of her debilitation in Virgo. Venus and Sun have to confront Rahu, while

Mercury had already had his stomach full. All of them have to face opposition

by Uranus as well.

So the negative trend will continue.

October 2014

We begin the month of October with several global issues,

the latest being the Hong Kong protests. I have been pointing out the abrasive

effects of Mars-Uranus and Jupiter all being in water signs from a KP perspective

and in Fire signs from a Sayana perspective. All it means is that the energies

of these planets flow easily and seamlessly and so the effects will be that

much more pronounced. Uranus signifies revolution and Mars will only push the

limits further. Jupiterian energy will only expand it further. Look at the

inhuman actions shown by the ISIS Militants in the Middle East. No one is

willing to give an inch. As pointed earlier some of the fast moving planets are

all getting into weakening positions and that does not augur well at all. The

only hope is Saturn, who rules structures, who is still in his exaltation sign.

So no far reaching structural changes would happen whether in the broader world

or in the market world, yet.

October 02 Mars squares

Chiron.. More of wounds and war.

October 03: Mars joins Uranus

in a trine. Jupiter is about to leave the trine. Sun squares Pluto. This

suggests more intensity. Markets which are falling will continue in the same

vein.

October 04: Mercury begins

its retrograde motion. Whatever trend which begins now, may have to be

revisited by October 16, when Retrograde Mercury conjuncts Sun. Importantly,

this Mercury activates the Saturn-Uranus midpoint at 08*of Capricorn. That Moon

is present in the vicinity is no help at all.. In addition, Mercury is in its extreme declination at 16.47 hours, today.So more stress is in the offing

in this retrograde.

October 05: Jupiter Uranus trine

ends. Mars instead begins a trine with Uranus. So spectacular fireworks will

continue. Effects will be seen on Monday.

October 06: With already a square with Pluto, Sun opposes Uranus.

This could be extremely volatile to say the least. Stop losses will disappear in

a jiffy and markets could move in both directions. Looking into other astro

formations, I favour declines to happen. Such effects are not seen on the day

of the formation but a little later. Mostly a third planet will channelize the

energy and cause it to manifest.Moon is increasingly important this month because of its involvement in two eclipses, Lunar on October 08 and Solar on October 23. On this day, Moon is at its closest distance from the Earth. So collective psyche will be affected.

October 07: It is now the

turn of Venus to square Pluto and force a standoff. Now this is the first

signature which signifies a powerful trough nearby. It is time to be careful of

shorts, but usually the trough forms at least after 5 trading days.From the chart below, we see how Uranus and Sun are getting into an opposition. On this day, October 07, Uranus gets into its declination extreme. This only makes the effect of Uranus more pronounced.

October 08: This is an interesting

day.

The Sun Uranus opposition energy is channelized by Moon opposing Sun and Rahu being very close. Full Moon happens a little before the Lunar Eclipse, at 16.21 hours.

In other words we have a Lunar Eclipse which is opposed by Uranus..

The Sun Uranus opposition energy is channelized by Moon opposing Sun and Rahu being very close. Full Moon happens a little before the Lunar Eclipse, at 16.21 hours.

In other words we have a Lunar Eclipse which is opposed by Uranus..

And that Uranus is in trine with Mars.

And that Mars is in trine with Jupiter!

Do we need more proof of volatility?

This Lunar eclipse occurs just on the horizon or below the

horizon. So the slanting rays of the Sun which gives a reddish hue to the Earth

due to refraction because of dust in the atmosphere, gives a reddish reflection

on to the Moon. So the Moon may appear red wherever it is visible. This is

called a Blood Moon and it is supposed to have evil portends.In fact we are in a Lunar instability period from September 29 to October 20, 2014.

October 09: Ketu joins Jupiter

and Mars in a trine. Rahu comes to the midpoint of Jupiter and Mars. Market

reversal is nearby if not on already. Cover all shorts and let us get ready for

a reversal. But wait till Sun passes Rahu. They are just less than 3 degrees

apart.

October 10: Venus does what

the Sun did. She manages to hold Pluto in a square and also opposes Uranus.

This is one more sign of a reversal.

October 13: Sun would have

passed the Rahu Ketu axis. He is in trine with Moon who also is in opposition

with Mars. Markets may turn up today, but may fall again when Venus comes in

contact with Rahu. In other words, this formation favours a double bottom.Moon also is at its maximum declination.

October 14: A remarkable day when

Ketu opposes Venus, Sun and Rahu. Trines

with Mars and Jupiter. This again is a sign of a big reversal.

October 15: This is the day when

Venus also conjuncts Rahu. Now there is only one more conjunction left. That is

when Mercury comes back to conjunct Rahu.

So all the pent up reversal energies may possible erupt and may

propel the market upwards.

In short our astrological expectations are for the market to

decline, form a double bottom and then climb up again. All

this could happen between October 07 to October 16.

Remember however that several aspects involve Uranus and

Mars here.

So be prepared if the market takes a

totally different series of movements!

Have stop losses and confirm the expected moves technically.

Here is a chart which shows Nifty dasa movements in October 2014...

Do trade carefully, because the skies do not look stable right now.

Here is a chart which shows Nifty dasa movements in October 2014...

Do trade carefully, because the skies do not look stable right now.

Monday, September 29, 2014

Astro Technicals Biocon September 29, 2014

Some of the readers of this blog have been asking for analysis of specific stocks, apart from the Nifty.Accordingly Iam posting the charts of one stock today. Some others shall follow.We will begin with an investment perspective first.Trading ideas can be discussed later.

The stock taken up for review is Biocon.As usual I shall post some charts with brief descriptions.

One of the first thing which strikes us from a long term perspective is that, the long term price cycle is coming to an end.Biocon is in the third impulse wave, within which it is forming the fourth wave. In the months ahead, it may travel down to the 420/430 levels again before a final 5th wave inside 3 is enacted.Since wave 2 ( shown in blue numbers) was a simple affair, wave 4 could be a complex and time consuming affair.

A closer look at the daily chart also reveals the same picture...Biocon is currently in wave b of 4 which could top out in the 515/520 range. Then it could be expected to swiftly come down to the 420/430 range.Note how the stock exhibits a mirroring tendency with the blur vertical line drawn from top of wave 3 as axis..

Here is another daily chart, from a long term view...

So as an investor, I would watch Biocon for some upticks, to offload and pick up the stock once it declines to the 420/430 range.

The stock taken up for review is Biocon.As usual I shall post some charts with brief descriptions.

One of the first thing which strikes us from a long term perspective is that, the long term price cycle is coming to an end.Biocon is in the third impulse wave, within which it is forming the fourth wave. In the months ahead, it may travel down to the 420/430 levels again before a final 5th wave inside 3 is enacted.Since wave 2 ( shown in blue numbers) was a simple affair, wave 4 could be a complex and time consuming affair.

A closer look at the daily chart also reveals the same picture...Biocon is currently in wave b of 4 which could top out in the 515/520 range. Then it could be expected to swiftly come down to the 420/430 range.Note how the stock exhibits a mirroring tendency with the blur vertical line drawn from top of wave 3 as axis..

Here is another daily chart, from a long term view...

So as an investor, I would watch Biocon for some upticks, to offload and pick up the stock once it declines to the 420/430 range.

Sunday, September 28, 2014

Nifty Astro Technicals September 29 to October 01, 2014

Last week, we had mentioned that stock prices are going to become volatile. We did see evidence of this. This truncated week is no better.And next week is going to be even worse.

As can be seen from the above charts, September 29 th is relatively calm, with some positive effect. But on September 30, Moon is close to Mars, and connected to Uranus,Jupiter and Chiron.Also Moon is in Mercury star, placed in enemy star Mars and in the 12th house.Third cusp sub lord is Moon which is connected to Mercury.This favours market decline.

On October 01st, Moon moves to Ketu star, which is connected to Mercury.Third cusp is ruled by Moon which is connected to Mercury through Ketu.Another day favoring shorts.

By October 06th , Mars trines Jupiter, increasing volatility and both ways movement,Venus squares Pluto, causing ripples in the market.This also favours trough formation.Additionally Sun also opposes Uranus.By October 05, Rahu is sitting directly on the 12th cusp

Instability caused by Rahu crowding continues.

All in all, we should favour shorting during this period.

Let us look at the levels, in different time frames....

Daily also indicates a

move down to 7860, or upto 7785 ( more likely) followed by a rise first to 8270?

5 Min chart favours an upmove to 8020/ 8040 levels before the downtrend resumes..

We conclude as follows. Technically and astrologically, we should expect the current counter up move to continue upto 8040 levels. Once there is a turn around, then we look to short the Nifty and go down along with Nifty till the 7785 levels.And then look for a more sustained rise. That could form the subject matter for next weekly discussion.

As can be seen from the above charts, September 29 th is relatively calm, with some positive effect. But on September 30, Moon is close to Mars, and connected to Uranus,Jupiter and Chiron.Also Moon is in Mercury star, placed in enemy star Mars and in the 12th house.Third cusp sub lord is Moon which is connected to Mercury.This favours market decline.

On October 01st, Moon moves to Ketu star, which is connected to Mercury.Third cusp is ruled by Moon which is connected to Mercury through Ketu.Another day favoring shorts.

By October 06th , Mars trines Jupiter, increasing volatility and both ways movement,Venus squares Pluto, causing ripples in the market.This also favours trough formation.Additionally Sun also opposes Uranus.By October 05, Rahu is sitting directly on the 12th cusp

Instability caused by Rahu crowding continues.

All in all, we should favour shorting during this period.

Let us look at the levels, in different time frames....

Monthly indicates a move up to 8400 and then a decline to 6500..Uptrend channels are also shown.

Weekly indicates a down move to 7750 range and an upmove later.

5 Min chart favours an upmove to 8020/ 8040 levels before the downtrend resumes..

We conclude as follows. Technically and astrologically, we should expect the current counter up move to continue upto 8040 levels. Once there is a turn around, then we look to short the Nifty and go down along with Nifty till the 7785 levels.And then look for a more sustained rise. That could form the subject matter for next weekly discussion.

Friday, September 26, 2014

Nifty Astro Technicals September 25 Follow up

Here is a follow up chart to the 5 min chart I had posted intra day.Price and time cycle bottoms are seen close to the current levels of 7912 and 7870. Since there are calculation imperfections and charting imperfections, let us take the price band of 7870 -7912 as important for a temporary bottoming out zone.Remember this is a 5 min chart. Larger time zones will give us far clearer cycle pictures. We will see them over the weekend.We should wait to see if prices recover from here. I have taken the closing prices to avoid intra day spikes.

However,there are three important risk factors emerging.

1. Astro picture is getting murkier.Negative factors are increasing.

2.FII Participation has been considerably reduced.

3. US markets are showing internal weaknesses.Daily lows have crossed the daily highs for a significant number of days.

In this back ground, today`s trading will assume significance, because this is the first day of a new settlement.If 7870 is broken, then larger time cycles are taking hold.Please see the momentum charts I had posted some days before.

However,there are three important risk factors emerging.

1. Astro picture is getting murkier.Negative factors are increasing.

2.FII Participation has been considerably reduced.

3. US markets are showing internal weaknesses.Daily lows have crossed the daily highs for a significant number of days.

In this back ground, today`s trading will assume significance, because this is the first day of a new settlement.If 7870 is broken, then larger time cycles are taking hold.Please see the momentum charts I had posted some days before.

Thursday, September 25, 2014

Nifty Astro Technicals September 25, 2014

Nifty is moving towards a 1920 bottom....Possibly a reverse irregular flat in the offing.Current leg is b of e. So c of e should move towards exceeding the 8180 levels, possibly go to just short of 8200.

Subscribe to:

Comments (Atom)