Last week we were cautious

because astrologically moon had more than one event surrounding it and

technically we felt that wave e was maturing…

As expected we saw a

reversal, some spectacular, gut swooping volatility and a seeming continuation

of the downtrend.

Since we are close to or

in the midst of a top formation, (we do not yet know, whether it is short term

or medium term), let us re-examine the long term pattern (monthly chart) we saw

last time..that of Cup and Handle.

“Although it is a

discretionary pattern, the cup-and-handle offers the opportunity to capture

large rallies. The pattern forms when a stock sells off (the left side of cup),

consolidates (the bottom of the cup), rallies back to the original sell-off

level (the right side of the cup), and finally pulls back (the handle). Volume can be used as a confirming indicator

when the pattern has been recognized. Trading the pattern involves placing an

entry order above the market when the handle is formed, and placing a

protective stop beneath the handle.”

So, we can technically

have a top here with Diametric wave F ending shortly and wave G beginning

downwards, shortly. Such a G, lasting

several months, could pull down Nifty to the top line of Cup and Handle

formation and form the classic pull back. This could take several months, and

could well get us into the middle of 2015.Let us not forget that the single

most factor of diametric formation is one of time equality, not price equality.

The current F wave should mature in early September, having completed 13 months

then. Even if we assume a G wave failure that could well take us into 2015.However

the G formation also will have several ups and downs giving us many profitable trading

opportunities.

So, the biggest up moves

in Nifty are yet to unfold….

On the weekly chart,

Nifty`s high was higher this past week and the low was lower. So was the close.

Now this is decidedly bearish. Long weeks of overbought positions now look to

unwind. In other words profit booking should continue. We follow the principle

of sell on rises till the last sell gets negated.

We use the opportunity to

move out of all speculative mid-caps and hold on to just the defensives.

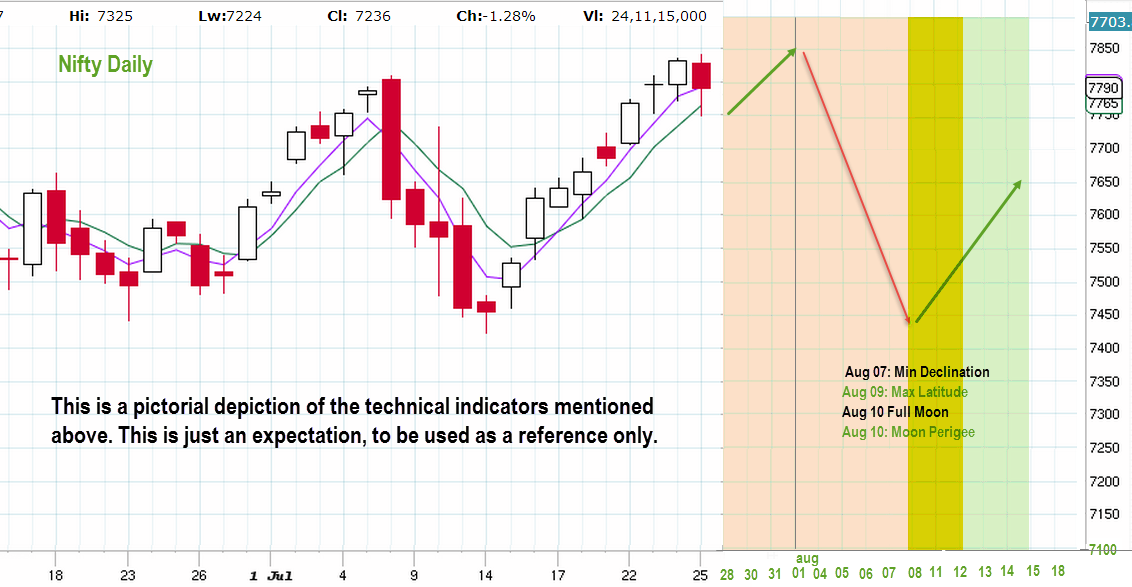

In the daily chart,

The lower b-d channel line

is now decisively breached. If 7442 goes, then we expect 7360 to hold for an

immediate bounce, which could open up the final g leg of the second corrective

in F.

Thus if there is a low

formation this week, then we expect a bounce back. No anticipation, but just

expectation.

Now after the upward g is

formed also, Nifty can go through one more diametric formation involving

another x wave. Since the channel is breached twice, that could be only a

remote possibility. Which means if g tops out, and Nifty breaks the lower

channel yet again, odds of G wave downwards having started will increase.

Faster upward bounce this

week shall confirm that wave f wave is completed.

First corrective will

achieve time cycle completion with the second corrective, by July 15

So, next week Nifty

movement should be quite interesting.

In the 30 minute chart, we

see the micro time cycle from the fall from 7800 levels nearly complete. This

also corresponds with a tentative abc formation of the ongoing f wave of the

second corrective.

Astrologically,

Volatility continues…..

Mars moves into Libra on July 14th.

Rahu also moves into Virgo, on the same date.

So does Ketu, from Aries to Pisces.

Venus moves from Taurus into Gemini.

Saturn becomes direct on July 20.

Uranus becomes retrograde on July 21.

This point to a fundamental shift in the investor and

trader psychology. Apart from Jupiter moving into Cancer last month, the most

important shift here is the movement of Rahu-Ketu axis from Libra-Aries to

Virgo-Pisces.

Early morning today, Mars was conjunct Rahu, in Libra.

And Venus was in trine to the Rahu-Ketu axis.

In short expect more volatility and also expect trend reversals in

most markets.

Next critical time zone is between June 21 to 23, 2014.

Sun Mars square, Sun Jupiter conjunction and Jupiter

Mars square will dominate in this period.

If any recovery happens this week, be watchful on the

above dates. The trend could reverse downwards more forcefully then. If the

downtrend persists this week, then expect a good up move in the period June 21

to 24.

As always, this observation is one of expectation and

preparedness. We take action only when the Market Technicals tell us to do so. If

we expect a down move and if the market breaks a key support, then we go in

more confidently with shorts. If the market closes above a resistance, and we

expect a positive move astrologically, we go long.