Tuesday, August 19, 2014

Monday, August 18, 2014

Sunday, August 10, 2014

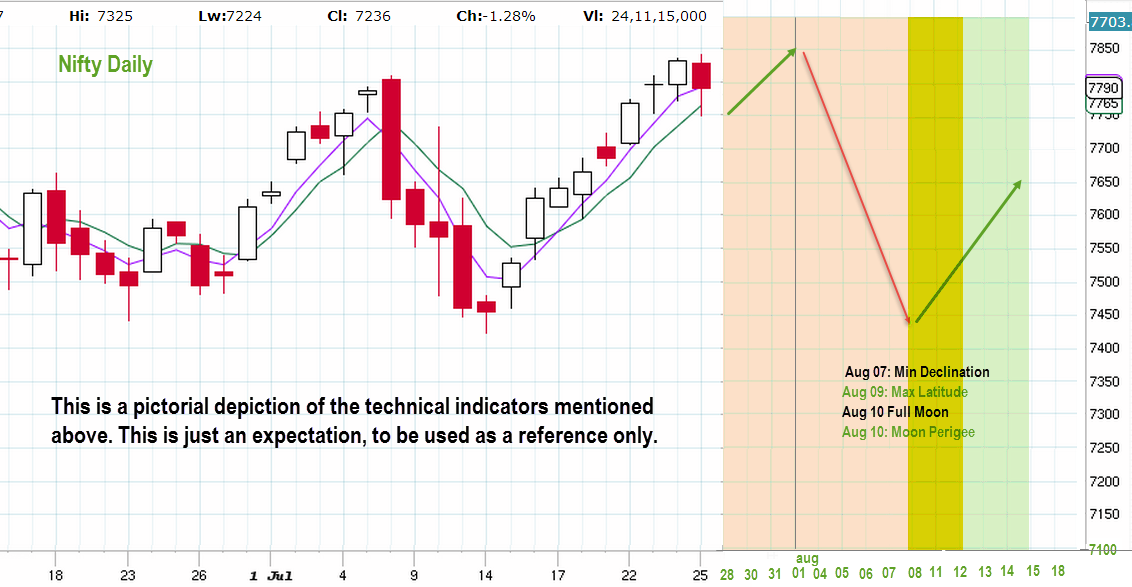

Nifty Astro Technicals August 11 to 14, 2014

This is how we concluded last week...

"Net, net, movement of c wave decides things for the time being. Astro indicates that the market could continue its negative ways till a turnaround happens by August 06 or 07."

We saw in the week just passed that wave c gave way to wave d on August 04 and 05th and then to a bigger wave e downward which has so far consumed three days, August 06, 07 and 08.

So what we have is now an expanding triangle with good down move potential....

So, increasingly we are getting into a " sell on rises" psychology , from a "buy on dips" situation.

This will be evident, if Nifty moves to 7200 levels swifty.If Nifty stalls at 7400 levels, and improves from there then we get to understand that one more upmove in Nifty could unfold.

So currently it is sell on rises strategy...

On daily levels,

On a weekly level...

So, on a larger frame, time cycles are changing.Nifty has gone without a meaningful correction for long.For the time being, Sell on rises as far as trading is concerned and selective investment picks seem to be a prudent approach to the markets.

Aug 18, 2014 Mercury opposition Neptune

Astrologically, this week on Monday may begin with an upward bang, but may continue to weaken day by day, till August 14.The stars seem to indicate that a turnaround may happen only somewhere in the period Aug 19 to 22.

So I would look to " sell on rises."7700 upside and 7400 on the low side are broadly the range.If Nifty rises beyond 7605, then 7650 should be a good short, providing it weakens there.If 7700 is taken out on the upside, then probably the correction has ended on the downside and the upward g has started. We have to be careful on both sides because we are in a triangle environment.

"Net, net, movement of c wave decides things for the time being. Astro indicates that the market could continue its negative ways till a turnaround happens by August 06 or 07."

We saw in the week just passed that wave c gave way to wave d on August 04 and 05th and then to a bigger wave e downward which has so far consumed three days, August 06, 07 and 08.

So what we have is now an expanding triangle with good down move potential....

So, increasingly we are getting into a " sell on rises" psychology , from a "buy on dips" situation.

So currently it is sell on rises strategy...

On daily levels,

On a weekly level...

So, on a larger frame, time cycles are changing.Nifty has gone without a meaningful correction for long.For the time being, Sell on rises as far as trading is concerned and selective investment picks seem to be a prudent approach to the markets.

Aug 7, 2014 Mars trine Neptune ( Trough by Aug 19 to 21)

Aug

8, 2014 Sun conjunct Mercury

Aug 8, 2014 Mercury trine Uranus

Aug 8, 2014 Mercury trine Uranus

Aug

8, 2014 Sun trines Uranus ( Trough by August 19 to 21)

Aug 8, 2014 Mercury square Saturn

Aug 9, 2014 Sun square Saturn ( Trough by August 22 )

Aug 8, 2014 Mercury square Saturn

Aug 9, 2014 Sun square Saturn ( Trough by August 22 )

Full Moon on August 10th, at 23.40 hours. This Moon is in Perigee, that means the closest to the Earth.So Moon could be pretty powerful tomorrow.

Aug 18, 2014 Venus conjunct Jupiter Aug 18, 2014 Mercury opposition Neptune

Astrologically, this week on Monday may begin with an upward bang, but may continue to weaken day by day, till August 14.The stars seem to indicate that a turnaround may happen only somewhere in the period Aug 19 to 22.

So I would look to " sell on rises."7700 upside and 7400 on the low side are broadly the range.If Nifty rises beyond 7605, then 7650 should be a good short, providing it weakens there.If 7700 is taken out on the upside, then probably the correction has ended on the downside and the upward g has started. We have to be careful on both sides because we are in a triangle environment.

Monday, August 4, 2014

Nifty Astro Technicals August 04 to 08, 2014

We had been expecting reversals for the past two weeks and Nifty did so a trifle rapidly in the past week.Nifty came down from 7841 on July 25 to 7603, on August 01, in just 5 trading sessions.Whether this is a correction or a trend reversal, only time will tell.I shall continue with my views and let you all decide. One thing is now very clear. When astro aspects bunch up and when there is also a technical confirmation, then surely there is an impact in the markets.

A look at the monthly cycles...

This could coincide with the completion of diametric wave F and the beginning of wave G downwards.As usual it did not take much to dampen the sentiments of markets all over the globe.

Here are the weekly cycles chart...

In the monthly cycles chart,the last candle was not considered, because it pertained to August which had just begun.So in the coming four weeks, if the Weekly manages to close above 7422, the bullish trend will be intact. Any closing above 7800 will be strongly bullish.However, looking at the weekly technicals, it looks like some more downside may be achieved on a weekly scale, before we resume the uptrend.Weekly cycles also have reached their 13 week cycle which indicates some reversal.

Here are the Stochastics...

After several weeks of bearish divergence, Nifty Stochastics has turned down below the 70 mark.Critical support point shall be the 36.28 mark.These cycles an indicators are cautioning us not be overly bullish at this point in time...

Neowave counts are shown on the daily chart.We appear to be in the c leg of wave f of larger Diametric wave, F.Even though irregular corrections are comparatively rare,we will not discount the possibility, especially if Nifty weakens strongly this week also.If wave c ends above 5422, then it is an irregular triangle with the d wave moving upwards and a final smaller e moving downwards.Post the triangle then we could expect a 300 to 400 point rise.

Another more bearish possibility is, since wave b was larger than wave a ( wave a was 387 points, as whereas wave b was 417 points), wave c could be equal to wave a- which means wave c could go down to 7454.So where wave c ends is an important point for post pattern analysis of Nifty movement.

30 minute chart makes things a little more clearer.Wave c of f had turned down from 7789 levels.Currently it is forming wave 3 of c.This means there is some more space to go down.

Enlarged chart brings out the point that wave c is still not complete.Maybe it will go beyond wave a in vertical length on Monday before a bounce forming wave 4. Technically wave 4 should not cross the 0-2 trendline drawn above. Depending on the angle of recovery, that means Nifty should not bounce beyond 7660 for this impulse to be valid. So the prudent trade would be to go short with a stop loss of 7660, if Nifty bounces on Monday.Of course if the bounce is more than 7660, then the Irregular flat gets converted into Irregular triangle or Irregular c wave failure patterns, both of which are bullish.Then we buy with a stoploss of 7660.

To sum up, our trade decisions depend on what Nifty would do with the current c wave.

That brings us to Astrology.

Can the planets give us some indications then?

Net, net, movement of c wave decides things for the time being. Astro indicates that the market could continue its negative ways till a turn around happens by August 06 or 07.

Now let us wait and watch! If things happen the way we want, well and good. If not we get powerful lessons to be learnt. Both are fine anyway.

Of course the regular disclaimers hold good. Trade with caution. No anticipation.Protect your capital always.

Have a great week.

A look at the monthly cycles...

This could coincide with the completion of diametric wave F and the beginning of wave G downwards.As usual it did not take much to dampen the sentiments of markets all over the globe.

Here are the weekly cycles chart...

In the monthly cycles chart,the last candle was not considered, because it pertained to August which had just begun.So in the coming four weeks, if the Weekly manages to close above 7422, the bullish trend will be intact. Any closing above 7800 will be strongly bullish.However, looking at the weekly technicals, it looks like some more downside may be achieved on a weekly scale, before we resume the uptrend.Weekly cycles also have reached their 13 week cycle which indicates some reversal.

Here are the Stochastics...

After several weeks of bearish divergence, Nifty Stochastics has turned down below the 70 mark.Critical support point shall be the 36.28 mark.These cycles an indicators are cautioning us not be overly bullish at this point in time...

Neowave counts are shown on the daily chart.We appear to be in the c leg of wave f of larger Diametric wave, F.Even though irregular corrections are comparatively rare,we will not discount the possibility, especially if Nifty weakens strongly this week also.If wave c ends above 5422, then it is an irregular triangle with the d wave moving upwards and a final smaller e moving downwards.Post the triangle then we could expect a 300 to 400 point rise.

Another more bearish possibility is, since wave b was larger than wave a ( wave a was 387 points, as whereas wave b was 417 points), wave c could be equal to wave a- which means wave c could go down to 7454.So where wave c ends is an important point for post pattern analysis of Nifty movement.

30 minute chart makes things a little more clearer.Wave c of f had turned down from 7789 levels.Currently it is forming wave 3 of c.This means there is some more space to go down.

Enlarged chart brings out the point that wave c is still not complete.Maybe it will go beyond wave a in vertical length on Monday before a bounce forming wave 4. Technically wave 4 should not cross the 0-2 trendline drawn above. Depending on the angle of recovery, that means Nifty should not bounce beyond 7660 for this impulse to be valid. So the prudent trade would be to go short with a stop loss of 7660, if Nifty bounces on Monday.Of course if the bounce is more than 7660, then the Irregular flat gets converted into Irregular triangle or Irregular c wave failure patterns, both of which are bullish.Then we buy with a stoploss of 7660.

To sum up, our trade decisions depend on what Nifty would do with the current c wave.

That brings us to Astrology.

Can the planets give us some indications then?

Net, net, movement of c wave decides things for the time being. Astro indicates that the market could continue its negative ways till a turn around happens by August 06 or 07.

Now let us wait and watch! If things happen the way we want, well and good. If not we get powerful lessons to be learnt. Both are fine anyway.

Of course the regular disclaimers hold good. Trade with caution. No anticipation.Protect your capital always.

Have a great week.

Sunday, July 27, 2014

Nifty Astro Technicals July 28 to August 01, 2014

As expected Nifty continued on its bullish ways and encountered some profit taking on Friday.However internals look weaker. Midcaps sold off much more than Nifty which itself was supported by some select scrips.

Let us see how the charts look like going forward...

Possibility 01, suggests that the upmove with much volatility, to continue this truncated week also.There could be a gap down on Monday due to global factors, but Nifty is expected to recover some more.As per Neowave, we are in wave b of wave f, which could terminate soon, possibly on August 01.Thereafter, wave c should commence as a down move..It could gather force once it crosses 7750-7730.

Another possibility is that we are in wave g of wave F which could move up some more and terminate wave F. Thereafter larger wave G should commence. This possibility can be confirmed only when the down move crosses 7422 convincingly on the downside.

These two charts above are daily charts.

Considering possibility one more favourably, and if we look at 30 min charts,

we see that wave b has enough complexity.

Here are the Fibo levels..

This is only after Nifty reverses decisively..

Let us look at Gann angles on a 30 min chart...

How does the weekly chart look with respect to Gann Angles?

We see that Nifty is rising towards the central median line, which has been turning points in the past...

If we consider Nifty cycles on a weekly scale....

We see that the previous significant low happened when the cycles phases shortened from 20 to 9 cycles.In the expansion phase, we are in the fourth phase..which is a final phase.Normal amplitude is 13 weeks and we have already completed 12 weeks. So a significant toip seems to be round the corner..

Here is a summation of all aspects till August 08, 2014...

Let us see how the charts look like going forward...

Possibility 01, suggests that the upmove with much volatility, to continue this truncated week also.There could be a gap down on Monday due to global factors, but Nifty is expected to recover some more.As per Neowave, we are in wave b of wave f, which could terminate soon, possibly on August 01.Thereafter, wave c should commence as a down move..It could gather force once it crosses 7750-7730.

Another possibility is that we are in wave g of wave F which could move up some more and terminate wave F. Thereafter larger wave G should commence. This possibility can be confirmed only when the down move crosses 7422 convincingly on the downside.

These two charts above are daily charts.

Considering possibility one more favourably, and if we look at 30 min charts,

we see that wave b has enough complexity.

Here are the Fibo levels..

This is only after Nifty reverses decisively..

Let us look at Gann angles on a 30 min chart...

How does the weekly chart look with respect to Gann Angles?

We see that Nifty is rising towards the central median line, which has been turning points in the past...

If we consider Nifty cycles on a weekly scale....

Here is a summation of all aspects till August 08, 2014...

July 21: Saturn turns direct on. Reversal period within 4 to

7 trading days)

July 22 Uranus turns retrograde (Reversal period within 4 to

11 trading days)

July 25, 02.30 am, Sun is conjunct Jupiter. Which means

Jupiter is conjunct. Crest should form soon. Specific date July 30- Outer date

August 08 2014.

July 26: Moon in Minimum Latitude

July 26: Jupiter in extreme declination

July 27: New Moon at 04:12 a.m.in Cancer

July 28 Venus opposes Pluto Crest formation within 2 days

(July 30)

July 28: Moon Apogee

at 09.05 a.m.

July 29: Mercury enters Cancer at 04.31 a.m. Sun and Mercury

will then be in the same sign. This means reduction in bullishness going

forward in the immediate future.

August 01: Venus forms a waning trine with Saturn on..

Trough formation within 11 days

August 01: Venus forms a waxing square with Uranus. Trough

formation within 9 days.

August 01: Same day, Mars squares Jupiter. Trough formation

within 10 days.

August 05: Venus squares Rahu

August 07: Mars waning trine with Neptune reversals within 5

to 7 days. Both trough and crests possible.

August 08: Sun conjuncts Mercury. On July 28th, the combust

zone begins.

August 08: Same day Sun and Mercury are in waxing trine to

Uranus.

Summation of what I expect to happen is shown in the chart

below. But then Iam still evolving this indicator. So use it with caution. Anyway,

no trading without stop losses or on anticipation, right?

Instead of elaborating the above in words, I have put the net expectation in this chart...

To sum up,

we expect Nifty to continue its up move this truncated week. There may be a down move on Monday which can be bought into.From August 04, Nifty is expected to reverse.

That could be either the final leg of wave f of F or wave g completion. If so we need to confirm if the move takes Nifty effortlessly beyond 7722.Personally I think one more upmove is pending in Nifty, the final wave g of F.

So trade carefully and enjoy the effort!

Next week, we will examine some KP Astro analysis...

Thank you for being my beloved readers..

Sunday, July 20, 2014

Nifty Astro Technicals July 21 to 25, 2014

For the long term we see that the 13 month cycle is quite

important for Nifty and so the 13th month will be September 2014.

Since time cycles expand and contract, we give an orb of +_2 months. We are

approaching a crest of significant proportions in the next two months.

Of course, we continue to believe that the very long term

trend is quite bullish.

However the weekly picture looks a little wobbly. It appears

that Nifty wants to relieve some of its overbought pressure

The daily picture is quite different…

There seems to be

that some more upside can be expected here…

Let us look at the wave counts….

Nifty had technically surpassed and closed beyond 7660, at 7664.This

marks the 61.8% retracement for the fall from 7809 to 7422.So the odds that

Nifty is forming a flat from the top of 7809 is higher now. Price, movements on

Monday should confirm the picture. If so, f wave of the diametric is just on. It

had completed one leg “a” at 7422 and currently it is “b”. This b wave could

retrace anywhere between 61.8 to 80% where it will be a weak b wave. If it

retrace 101 to 123.6% it will be a normal b wave and anything beyond that it

will be strong b wave. We expect b wave to behave normally and later on go back

to the base or beyond, as wave c of f, from where wave” a started. If so, then

wave g of the complex corrective will unfold later on as an upmove.

So we expect the bull move to continue this week with

volatility. July 24th and thereafter have to be watched carefully.

A look at the short term cycles..

When can we see trend reversal changes?

For that,

Let us examine the Astro picture.

Whew! What an array of indications!

Saturn turns direct

on July 21, 02:05; 16 a.m. Crest formation is round the corner.( 4 to 7 trading

days)

Uranus turns

retrograde on July 22, 2014.(4 to 11 trading days)

On 22 July, Tuesday

at 12.19 pm, Mercury will be in full opposition to Pluto. Market could rise

towards this date and time.

July 22: Venus in

extreme declination at 10.14 pm

July 23 : Moon in maximum declination

On July 23rd,

Moon will be in Magayeeram, in Taurus, with Sun in Cancer. July

24: Declination extreme for Mercury

July 25, 02.30 am,

Sun is conjunct Jupiter. Which means Jupiter is conjunct. Crest should form soon.

July 26: Moon in Minimum Latitude

July 26: Jupiter in

extreme declination

July 27: New Moon at 04:12 a.m.

July 28 Venus opposes

Pluto

July 28: Moon Apogee at 09.05 a.m.

July 29: Mercury

enters Cancer at 04.31 a.m. Sun and Mercury will then be in the same sign

Venus forms a waning

trine with Saturn.. Trough formation within 11 days

This looks like the current uptrend could terminate by July

24 or 25, 2014.Then b would have been completed and the downward c should begin.

The next option is that the current upward wave movement be

construed as wave g of the diametric.. In such a scenario, wave g has opened

upwards and may continue for 3 or 4 days. But this count now looks improbable

now.Closer to the New Moon, looks like an opportunity to create shorts, with stop losses.Last but not the least, allow price to move first in the direction of our expectation, before any trade steps are initiated.

Trade carefully!

Sunday, July 13, 2014

Nifty Astro Technicals July 14 to 18, 2014

Last week we were cautious

because astrologically moon had more than one event surrounding it and

technically we felt that wave e was maturing…

As expected we saw a

reversal, some spectacular, gut swooping volatility and a seeming continuation

of the downtrend.

Since we are close to or

in the midst of a top formation, (we do not yet know, whether it is short term

or medium term), let us re-examine the long term pattern (monthly chart) we saw

last time..that of Cup and Handle.

“Although it is a

discretionary pattern, the cup-and-handle offers the opportunity to capture

large rallies. The pattern forms when a stock sells off (the left side of cup),

consolidates (the bottom of the cup), rallies back to the original sell-off

level (the right side of the cup), and finally pulls back (the handle). Volume can be used as a confirming indicator

when the pattern has been recognized. Trading the pattern involves placing an

entry order above the market when the handle is formed, and placing a

protective stop beneath the handle.”

So, we can technically

have a top here with Diametric wave F ending shortly and wave G beginning

downwards, shortly. Such a G, lasting

several months, could pull down Nifty to the top line of Cup and Handle

formation and form the classic pull back. This could take several months, and

could well get us into the middle of 2015.Let us not forget that the single

most factor of diametric formation is one of time equality, not price equality.

The current F wave should mature in early September, having completed 13 months

then. Even if we assume a G wave failure that could well take us into 2015.However

the G formation also will have several ups and downs giving us many profitable trading

opportunities.

So, the biggest up moves

in Nifty are yet to unfold….

On the weekly chart,

Nifty`s high was higher this past week and the low was lower. So was the close.

Now this is decidedly bearish. Long weeks of overbought positions now look to

unwind. In other words profit booking should continue. We follow the principle

of sell on rises till the last sell gets negated.

We use the opportunity to

move out of all speculative mid-caps and hold on to just the defensives.

In the daily chart,

The lower b-d channel line

is now decisively breached. If 7442 goes, then we expect 7360 to hold for an

immediate bounce, which could open up the final g leg of the second corrective

in F.

Thus if there is a low

formation this week, then we expect a bounce back. No anticipation, but just

expectation.

Now after the upward g is

formed also, Nifty can go through one more diametric formation involving

another x wave. Since the channel is breached twice, that could be only a

remote possibility. Which means if g tops out, and Nifty breaks the lower

channel yet again, odds of G wave downwards having started will increase.

Faster upward bounce this

week shall confirm that wave f wave is completed.

First corrective will

achieve time cycle completion with the second corrective, by July 15

So, next week Nifty

movement should be quite interesting.

In the 30 minute chart, we

see the micro time cycle from the fall from 7800 levels nearly complete. This

also corresponds with a tentative abc formation of the ongoing f wave of the

second corrective.

Astrologically,

Volatility continues…..

Mars moves into Libra on July 14th.

Rahu also moves into Virgo, on the same date.

So does Ketu, from Aries to Pisces.

Venus moves from Taurus into Gemini.

Saturn becomes direct on July 20.

Uranus becomes retrograde on July 21.

This point to a fundamental shift in the investor and

trader psychology. Apart from Jupiter moving into Cancer last month, the most

important shift here is the movement of Rahu-Ketu axis from Libra-Aries to

Virgo-Pisces.

Early morning today, Mars was conjunct Rahu, in Libra.

And Venus was in trine to the Rahu-Ketu axis.

In short expect more volatility and also expect trend reversals in

most markets.

Next critical time zone is between June 21 to 23, 2014.

Sun Mars square, Sun Jupiter conjunction and Jupiter

Mars square will dominate in this period.

If any recovery happens this week, be watchful on the

above dates. The trend could reverse downwards more forcefully then. If the

downtrend persists this week, then expect a good up move in the period June 21

to 24.

As always, this observation is one of expectation and

preparedness. We take action only when the Market Technicals tell us to do so. If

we expect a down move and if the market breaks a key support, then we go in

more confidently with shorts. If the market closes above a resistance, and we

expect a positive move astrologically, we go long.

Sunday, July 6, 2014

Nifty Astro Technicals July 07 to 11, 2014

So, after a long gap of 11 months, this blog is getting activated. Markets of course are forever and they have continued to churn out profits and losses to the millions who follow them...

Looking at the long term charts of Nifty, we see a powerfully bullish picture emerging...

Minimum target from the Cup and Handle formation is 10,471.Of course the path will be full of ups and downs and all downs become important for investors because they represent buying opportunities.

From a Neo Wave perspective also, the current situation is quite important ...

In the month of August 2013, wave E ended and wave F had began upwards in the form of complex correctives, well channeled. That they are so well channeled makes them complex correctives rather than impulse waves.First corrective was a diametric and it appears that the second corrective also may be one. This means the current upthrust of "e" could end in a few days and a down move of "f" could start. This may be followed by another final upmove of "g".Then there could be a larger correction which could bring Nifty down, outside the channel and consolidate. End of "G" should mark the beginning of " Mother of all bull markets".

So ride the present upmove but be vigilant. The move is fast maturing and will produce volatility, associated with the f and g legs. Then corrections could happen..sometimes quickly.

Let us look at short term astro effects ...

We see most of the latest turning points happened when more than one Moon effects were present.The latest Moon declination and Full Moon was the start of this latest upmove.

Between June 11 to 13,there are four separate Moon effects. Saturn also in in it's extreme.

Additionally Moon is in the midpoint of Uranus and Mars, on July 12.And on July 16, Sun triggers the Rahu Ketu axis.

So a minor correction should ensue, shaking out all weak hands.

All the best for the pre Budget and post budget markets to all my friends!

Disclaimer:Whatever given here is just my point of view. Acting on them is solely up to you.I cannot be responsible for profits or losses or lack thereof owing to actions based on these observations

Looking at the long term charts of Nifty, we see a powerfully bullish picture emerging...

Minimum target from the Cup and Handle formation is 10,471.Of course the path will be full of ups and downs and all downs become important for investors because they represent buying opportunities.

From a Neo Wave perspective also, the current situation is quite important ...

In the month of August 2013, wave E ended and wave F had began upwards in the form of complex correctives, well channeled. That they are so well channeled makes them complex correctives rather than impulse waves.First corrective was a diametric and it appears that the second corrective also may be one. This means the current upthrust of "e" could end in a few days and a down move of "f" could start. This may be followed by another final upmove of "g".Then there could be a larger correction which could bring Nifty down, outside the channel and consolidate. End of "G" should mark the beginning of " Mother of all bull markets".

So ride the present upmove but be vigilant. The move is fast maturing and will produce volatility, associated with the f and g legs. Then corrections could happen..sometimes quickly.

Let us look at short term astro effects ...

We see most of the latest turning points happened when more than one Moon effects were present.The latest Moon declination and Full Moon was the start of this latest upmove.

Between June 11 to 13,there are four separate Moon effects. Saturn also in in it's extreme.

Additionally Moon is in the midpoint of Uranus and Mars, on July 12.And on July 16, Sun triggers the Rahu Ketu axis.

So a minor correction should ensue, shaking out all weak hands.

All the best for the pre Budget and post budget markets to all my friends!

Disclaimer:Whatever given here is just my point of view. Acting on them is solely up to you.I cannot be responsible for profits or losses or lack thereof owing to actions based on these observations

Friday, August 2, 2013

Mercury Sookshma

Nifty`s Saturn Sookshma ends on August 03, 08:37:07 Hrs and then on till August 29, 2013,05:31:51 hrs, it is Mercury Sookshma in Venus Antara, Venus Bhukti and of course Rahu Dasa.

What has been the past record?

In 2008 January to February 21, the market goes through two way movements during Saturn Sookshma and declines to form a bottom, after Mercury Sookshma.

During Mercury Bhukti, Saturn Sookshma, market forms a bottom and the rise gets pronounced during Mercury Sookshma.

Ketu Sookshma last year see a declining trend during Mercury Sookshma.

So we reach August 2013.there is every likelihood of a market reverse to the upside. For the Nifty, my bet is, it may go upto 5940 or thereabouts.

What has been the past record?

In 2003, we see the downward trend changed exactly on the onset of Mercury Sookshma.

During Jupiter Bhukti,Venus Antara and Saturn Sookshma in 2005, market bottomed out and reversed upwards.

During Mercury Bhukti, Saturn Sookshma, market forms a bottom and the rise gets pronounced during Mercury Sookshma.

Ketu Sookshma last year see a declining trend during Mercury Sookshma.

So we reach August 2013.there is every likelihood of a market reverse to the upside. For the Nifty, my bet is, it may go upto 5940 or thereabouts.

Wednesday, July 31, 2013

Subscribe to:

Comments (Atom)