Thursday, February 12, 2015

Nifty Technicals Update Feb 12, 2015

This is an updated cycles chart.Due to the interplay between the smaller blue cycle and the longer and more powerful red cycle..(blue wants down and red wants up), Nifty is treading water at 8600- 8650 levels. Eventually the red cycle direction may prevail.Comparing with the previous red cycle and Nifty behaviour, it looks to be a more sedate rise, cycles wise, rather than spectacular and Nifty may or may not cross the previous top in one go. Actually it is academic because as a trader, I would simply hang on the coat tails of Nifty and go where she goes.Wave wise, the drop to 8400 levels was wave d and the next rise should be wave e and it may cross the previous top.

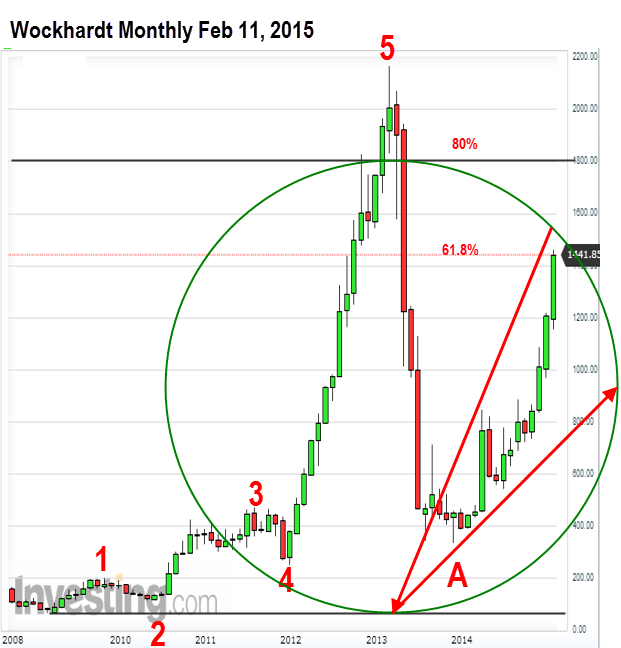

Wockhardt --Feb 11, 2015

Pictures speak louder than words. Wockhardt is in a corrective mode. Look to see if it tops out somewhere between 1600 to 1800 in the current upmove. Then wave c should begin down in a prolonged correction. So short term is up, but medium term is down..

Friends, it is extremely difficult for me to keep analysing individual stocks on specific requests. Paucity of time is the major reason. Despite mentioning this several times, I keep getting such requests!So, I intend to start an analysis section for stock specific requests, but it may not be for free.Also the service will commence only after April, 2015, when Jupiter becomes direct! If you are interested you may contact me at my mail id, tekkiesuresh@gmail.com.

Sorry, but there is no other way...

Friends, it is extremely difficult for me to keep analysing individual stocks on specific requests. Paucity of time is the major reason. Despite mentioning this several times, I keep getting such requests!So, I intend to start an analysis section for stock specific requests, but it may not be for free.Also the service will commence only after April, 2015, when Jupiter becomes direct! If you are interested you may contact me at my mail id, tekkiesuresh@gmail.com.

Sorry, but there is no other way...

LT An update Feb 11, 2015

This is an update and course correction for the views given on LT in the following post:

http://niftyastrotechnicals.blogspot.in/2015/01/astro-technicals-larsen-and-toubro.html

Let us see how LT is likely to fare in the coming days....

LT has ended its long term correction and is now in a new impulse. Currently we are close to topping out in wave 1. Some correction in wave 2 should bring the stock down. It should be an excellent buy later in the year, for a prolonged rise.

For the very short term it is a buy, but be careful of overhead resistance at 1740 levels. That should be a temporary top for a second wave reaction.

http://niftyastrotechnicals.blogspot.in/2015/01/astro-technicals-larsen-and-toubro.html

Let us see how LT is likely to fare in the coming days....

For the very short term it is a buy, but be careful of overhead resistance at 1740 levels. That should be a temporary top for a second wave reaction.

Wednesday, February 11, 2015

Ashok Leyland a technical view ( February 10, 2015)

Since the long term chart is showing that wave 3 has ended and 4 has begun, it would be prudent for investors,to use the imminent upmove on budgetary conditions to get out of Ashok Leyland for the time being. For the short term of a month or so, Ashok Leyland can be bought and possibly sold off post budget.

After the 4th wave, which may last a few months, (fewer than wave 2 because wave 2 was complex and so wave 4 could be simple) Ashok Leyland could be bought for the medium term and ride wave 5 upwards into 2016. If Ashok Leyland is available between Rs 45-50 after the budget correction, it may be a good medium term buy.

After the 4th wave, which may last a few months, (fewer than wave 2 because wave 2 was complex and so wave 4 could be simple) Ashok Leyland could be bought for the medium term and ride wave 5 upwards into 2016. If Ashok Leyland is available between Rs 45-50 after the budget correction, it may be a good medium term buy.

Sunday, February 8, 2015

Havells India Astro Technicals

Havells has an interesting stock market chart. Lagna is Taurus and Yogakaraka Saturn is in the Lagna! ( He also has a dualistic 12th house role).lagna lord Venus is in the 11th and is exalted. Fifth lord Sun, is also in the 11th, with Venus.So the stock has great performance potential.Jupiter and Ketu are troublesome, since they represent 8 and 12 houses. Since Mars owns 7th house,it implies neutrality.

Currently Havells is going through Rahu dasa, Saturn anthara and Mars sub period.

Rahu is in Moon star in the 5th.Saturn is in 7th and Mars is in Jupiter star which is a malefic.

After the present down trend which is a correction, Havells can be accumulated

Long term wave counts suggest that Havells has made a top.Correction has started currently.

Daily chart shows the wave counts broken down ...we seem to be in wave c of a, in the downtrend.

Aurobindo Pharma update

Last time we had mentioned that Aurobindo shall touch 1238 and then reverse into 4th wave. Actually it went up to 1275 and now has closed at 1109.Looks like 4th wave has begun. First level should be 23.6 % retracement level of 1008. Since wave 2 was simple, as per alternation theory, wave 4 could be complex and time consuming.

Astro wise, Aurobindo is going through Rahu Dasa Venus antara, upto October 30, 2017. Rahu is currently in Moon star, and Moon is a 12th house significator. By July 14th, Rahu will move into Sun star. By July 28th, 2015, Venus will become retrograde at 06.38 degrees in Leo, in the star of Ketu.Aurobindo may start improving from then on. Currently use every rise to lighten positions.

Let us wait for one more bear candle in monthly to confirm long term counts.

Astro wise, Aurobindo is going through Rahu Dasa Venus antara, upto October 30, 2017. Rahu is currently in Moon star, and Moon is a 12th house significator. By July 14th, Rahu will move into Sun star. By July 28th, 2015, Venus will become retrograde at 06.38 degrees in Leo, in the star of Ketu.Aurobindo may start improving from then on. Currently use every rise to lighten positions.

Let us wait for one more bear candle in monthly to confirm long term counts.

Biocon Update Feb 06 2015

Biocon looks to bottom out in the 390 to 400 range. Wave 5 of 3 should begin soon. Expected target is 550 levels.Those levels should see the culmination of wave 3.

Nifty Astro Technicals Feb 06 to 13, 2015

This was our observation last week, ( February 01, 2015):

"Looking at astro formations, we begin the week with Aquarius

rising and Moon in Gemini, in the 5th.

Jupiter retro is in the 6th, Venus and Sun are in the

12th.After a weak start markets may bounce back, especially till the Full Moon.

Full Moon on 4th February, triggers the Uranus Mars midpoint

and gives an effect which is as if Mars is in conjunction to Uranus. Already

Uranus and Ketu are inflamed. Since they are in Mercury star, they have been

giving sudden, surprising moves in all markets, especially in the currency market.

With this translation, Mars also adds its aggression to the equation. Since

Pisces represents religious beliefs through Jupiter, terrorism could also

escalate, till Jupiter trines with these planets. More volatility and

divergences are expected in financial markets.

So the Full Moon may

provide fresh triggers to continue the

downtrend.

The uptrend which began on January 15th, did not change

track on January 22, when Mercury became retrograde, but went on right upto

January 30, 2015. We have often seen that if a market does not change direction

when Mercury goes retrograde, often does so during the mid-period of Mercury

retrograde.

February 02, 2015 is the tradable Mercury retro mid period

day. And February 11, happens to be the

date when Mercury becomes direct.

Nifty started a down move on January 30, one trading day

before Mercury retro mid period day of February 02.

So, will this down trend continue till Mercury

becomes direct? That is, till February 11, 2015?

By the weekend, another important aspect will come into

play. Capricorn Sun will oppose Cancerian, retro Jupiter. Given its customary orb, we may see a reversal in the period February

11 to 16, 2015.

So the question is,

considering Mercury phenomenon and Jupiter Sun aspect together, will we see a

bottom next week?"

Our observations this week...

Mercury continues its retrograde motion and Nifty followed suit throughout the week. We expected a bounce by the Full Moon and that too happened. Full Moon triggered further down fall and Nifty came down upto 8646 before closing at 8661.

Mercury becomes direct on February 12th.Transiting Lagna at 09 am starts transiting in the ninth house for Nifty Futures, from February 13 onwards. So most probably we may see a low formation this week and Nifty should get into pre budget rally from the weekend.

Sun Jupiter opposition occurred on February 06, 2015.Nifty low formation could also be by February 12/13, based on this important aspect.

Of course these are just our assumptions. Let us watch and ascertain what really happens.

Starting from February 16th right upto March 15th, 2015, we are about to go through an intense astro time. There are several aspects which will culminate and bring in major effects in all walks of life, including financial markets.

Entry of Mars into Pisces and Venus into Aquarius merely marks a beginning.

Looking at technicals, first on a weekly mode.,

On the longer term we find that we are entering a very important reversal period by March 16-20 2015, based on 56 /57 week trends.

On a shorter time period. Nifty has formed an evening star on the weekly. This means some more down move is to be expected this week, before a low is formed.Looking at triangular formation in stochastics, maybe not more than 150 points? It does not matter..if short, just ride the pony, till it bucks.

Cycle updates continue on expected lines. Interaction between the 23 day and 108 day cycle should produce a shallow bottom. Interestingly 12/13 March is the classical cycle top. March 16 is the weekly cycle top. That is also the time zone for the last Uranus Pluto square..

Cycles also point out the same..9082 is the level to watch out for. Black and red cycles form a pair. Blue and green cycles another pair.You can see that Nifty had exceeded the blue cycle target and has reversed. 8531 is an important level to watch out for. It is formed inside the yellow band.

Finally Neo waves...

Trade cautiously. We are passing through uncertain times...

Subscribe to:

Comments (Atom)