Wednesday, January 30, 2013

Nifty Astro Technicals Jan 29, 2013

This has been the dominant theme of our markets for some time.Domestic Institutions are selling while FII buying in larger quantities offsets this selling and keeps pushing the markets forward.

Astrologically Rahu represents foreigners and their activities and so when Rahu conjuncts Saturn on September 17, 2013,there could be a major trend change in this activity. Anyway it is too early to be bothered.

With this back drop we look at the wave counts, and this is how they look to me. February 08/11 could be an important turning date. Minor wave 3 could terminate and wave 4 could begin....

Sunday, January 27, 2013

Nifty Astro Technicals Jan 28 to Feb 01,2013

We look at the current week by going into a future

date (Feb 08 2013) and then travelling towards this week (Jan 28 to Feb 01,

2013.)

What do we see?

Jupiter after turning direct comes back to form a

trine with Natal Neptune. This trine formation will be for the second time (

the last time we saw this was on January 22, 2013.And Nifty reacted from 6101

to 6008, in 2 two days. But since the trine formation continued to be intact

then, Jupiter was moving retro into further inner movements with Neptune, we

did not see further reactions.

But from Feb 08 onwards, Jupiter is

going to gather speed and move away from Natal Neptune, which means the basic

bullish trine formation will begin to develop serious cracks. ……………………….(1)

By Friday the 13th, Rahu in

Libra will be squaring Natal Uranus- this is indicative of more long term

trouble……(2)

Mars and Mercury join hands and attack

Jupiter squarely. Effect to be seen on Feb 11, Monday……(3)

While Sun

forms a conjunction with Natal Uranus, more troubling is the square shown between Sun, Rahu and Ketu…..(4)

At 13:37 degrees Venus has completed its

positive trine with Jupiter. ….(5)

There are no smaller or faster planets

left in the arc Scorpio to Capricorn, to form trines with Jupiter……..(6)

Again, on Feb 11, Monday, Venus will be

square with Saturn…(7)

So looking at the font colours, it looks like predominantly

things are going to be downhill from February 08 onwards. But remember, the bid

fella, Jupiter is in Taurus and he does not like changing trends when in Taurus.

So between February 2013 and May 2013, we may expect a topping out, (the 5 wave

phenomena), wave A downwards and a big wave B upwards, which may rival the tops

in February, whether it is 6100 or 6200 or 6300, is immaterial.

After Taurus, by May end, Jupiter moves into

Gemini. Gemini is a dualistic sign and even worse, in Gemini, Jupiter will get

into a square aspect with Uranus and an opposition aspect with Pluto. But all

these are currently far away in August 2013 ( in fact we could witness an

unholy trine relationship with Saturn somewhere in July 2013, where everything

will look rosy for some time..) and so let us get back to the only thing which

is real—the present moment. Now!

Let us back track. Between January 28 and February

11, there are ten trading days.

Astrologically, at least we expect February 08, to

be a tipping point. What may happen in between?

On January 28, we are emerging out of a

Sun-Jupiter trine. And Venus is emerging out of a trine with Ketu. But with

Mercury in Moon and Moon in Mercury, Monday could be a slightly negative day. In

fact with a Full Moon on January 27, 2013, we are on a Full Moon deviation

period that is Moon is between Full Moon and First Quarter. And when Moon is in

Cancer, historically we had always had a low which could be January 28. (Mind

you, Iam not talking about a bottom, but a low).

We can buy a little confidently because

traditionally the next Lunar top can be in Libra which is on February 04; 2013.It

is also a Jupiter day- a direct Jupiter day.

So short on Monday morning, buy during the dying

moments of January 28, 2013, hold it till January 31, closing hours. Short

again on January 31, and cover on 04th evening. Simultaneously buy

and sell everything on February 08th.

This is what Financial Astrology says. But let us

be prudent shall we? Let us wait for the dame, Nifty to tell us what she

intends to do? Let us follow the price movements first before deciding to trade.

Have a great week of trading! As a true blooded technician I have chosen to ignore the fundamental reality of RBI Interest rate effects and consequent market reactions.After all, we traders believe that the price reflects all other effects don`t we?

Friday, January 25, 2013

Nifty Astro Technicals-- Lunar Reversals Jan 24 2013

January28/29 2013, may be a reversal day- Nifty could bottom out in the near term on Jan 25 and start moving up, next week.

Nifty Astro Technicals for January 25,,2013

Nifty weakens for a third day, in a row.Still it is moving only inside the Keltner channel. FIIs continued their cash market, net positive purchases, to the tune of Rs 10263 million.However they have sold heavily in the directives segment, to the tune of Rs 6144 million.( By far, the highest this month.)This has erased the premium off Nifty futures. DIIs continue to sell-they sold a net of Rs 4139 million.

So, the FIIs seem to be short term short and long term long.

Look what is happening to the broader markets...

While the broader markets are selling off, Nifty is in a relatively comfortable situation.

Astrologically, the markets are going to improve next week. Let us wait and see...

So, the FIIs seem to be short term short and long term long.

Look what is happening to the broader markets...

While the broader markets are selling off, Nifty is in a relatively comfortable situation.

Astrologically, the markets are going to improve next week. Let us wait and see...

Thursday, January 24, 2013

Nifty Astro Technicals January 23 2013

But look at some related indices....

Wednesday, January 23, 2013

Sunday, January 20, 2013

Technicals part of Nifty Astro Technicals January 21 to 25 2013

Let us look at the technicals of our markets this coming week. Before we get into the wave analysis, here are a few charts...

I have used a 9 period Keltner channel which is shown as a green band in this weekly chart of Nifty futures.Coming week is the 34th week from December 20, 2011 and 34 is a significant Fibo number.

Nifty Futures monthly has gone above the upper band of Keltner channels.This week or the week after there could be a reaction.

If we consider the second option of Nifty extending beyond its terminal pattern, then we have the following.

In this option if wave 5 extends, then the diametric pattern which we had been expecting may not be happening. But it is still early because Nifty could technically go up to 6335.90 and still the pattern of diametric could be valid.

Or else...

I have used a 9 period Keltner channel which is shown as a green band in this weekly chart of Nifty futures.Coming week is the 34th week from December 20, 2011 and 34 is a significant Fibo number.

Nifty Futures monthly has gone above the upper band of Keltner channels.This week or the week after there could be a reaction.

In this option if wave 5 extends, then the diametric pattern which we had been expecting may not be happening. But it is still early because Nifty could technically go up to 6335.90 and still the pattern of diametric could be valid.

Or else...

Nifty Astro Technicals-A few Fundamentals

An interesting trend is visible in the article in this link..

http://online.wsj.com/article/SB10001424127887324595704578239632598444930.html

A few extracts:

".....Now, some signs are indicating that maybe, possibly, the tide is beginning to reverse.

Stocks started 2013 with a bang. For the week ended Wednesday, U.S. investors ploughed $18 billion into stock mutual funds and exchange-traded funds, the largest one-week total since June 2008, before the worst of the financial crisis hit....."

".... Fuelling expectations that a longer-term shift out of

bonds and into stocks may finally take place is a growing nervousness that bond

yields are dangerously low. As 2012 drew to a close, U.S. Treasury yields

weren't far from record lows thanks to the Federal Reserve's unprecedented

effort to pump money into the financial system through bond purchases. That

sent prices up, and yields down….”

http://www.reuters.com/article/2013/01/18/investing-fundflows-epfr-idUSL1E9CIBAY20130118?feedType=RSS&feedName=bondsNews&rpc=43

"...Emerging market stock funds attracted $5.83 billion of the net new cash in the week ended Jan. 16. Meanwhile, investors pulled $1.79 billion out of U.S. stock funds, the fund-tracking firm said.

Demand for stocks broadly speaking, has rebounded so far this year, with the latest inflows marking the second straight week in which retail investors contributed new money. That has not occurred since April 2011, EPFR Global said. Last year, investors pulled $69.1 billion out of all stock funds while pouring $493.6 billion into bond funds, the firm added...."

http://www.reuters.com/article/2013/01/18/investing-fundflows-epfr-idUSL1E9CIBAY20130118?feedType=RSS&feedName=bondsNews&rpc=43

"...Emerging market stock funds attracted $5.83 billion of the net new cash in the week ended Jan. 16. Meanwhile, investors pulled $1.79 billion out of U.S. stock funds, the fund-tracking firm said.

Demand for stocks broadly speaking, has rebounded so far this year, with the latest inflows marking the second straight week in which retail investors contributed new money. That has not occurred since April 2011, EPFR Global said. Last year, investors pulled $69.1 billion out of all stock funds while pouring $493.6 billion into bond funds, the firm added...."

Reading all of these together,

- People are perceiving bonds to be riskier going forward and are pulling money out of bonds.

- This money is finding its way into stock markets, where they perceive that the returns are far better in dividend yielding stocks rather than from bonds.

- A substantial amount of money, out of bonds, is flowing into emerging market funds.

- Indian stocks are considered to be a better bet among emerging market instruments, because the Government has been doing the right things in terms of attempting to reign the fiscal deficit, make foreign investors more comfortable with India,reduce subsidies,and re move bottlenecks in Infrastructure and projects investments. So more FII funds are expected to flow into our markets.

- Since the markets had been in an up trend for quite some time, money may flow into large caps and index constituents.

- Real time economic effects are yet to be seen on the ground, but typically stock markets react first and will front run the actual economy.

- Government may continue this mode till the budget session. Post budget, they will start taking populistic measures to appease the masses.This will have a negative effect on the markets and they will begin a prolonged negative cycle.

Nifty Astro Technicals-Astro View Jan 21 to 31 2013

Last week we had expected Nifty to move up till January 18, 2013. We had expected to see a correction either on January 18 or within a few days.

We were expecting a translation of Venus conjunction Pluto before which Venus had squared Pluto.

Just like in Technical Analysis and in Wave Theory, the major trend or cycle will dominate and influence the medium or shorter trends, always. This is very true in Financial Astrology as well.

So what was the mistake I did last week? It was not ascertaining the underlying major trends first before examining the medium or shorter trends.

I shall not make this mistake again.

What constitutes Long, Medium and Short term trends in Financial Astrology?

Red line represents Uranus square Venus and Black line is Venus conjunct with Pluto.

Let us see the effect on the price chart...

So, the current Uranus-Venus- Pluto translation also has got the potential to get modified.

How do we expect it to pan out?

To understand that better, we need to see a couple of long term/ medium term effects in the offing..

So far our understanding is that, for a slightly longer term, Neptune and Jupiter will cause bullishness.

For the medium term, Uranus and Mars will cause bullishness but reversals in the short term also is on the cards.

Jupiter when it becomes direct will cause reversal of the current up moves.

One more time we look at this week`s charts...

Mars get into a square with Rahu and Ketu axis. And Sun will trine Jupiter.

So what we see is positive and negative forces acting alternatively and in tandem.

What do we conclude:

Astrologically, Nifty is bound to go up higher till possibly May, 2013, because of Jupiter in Taurus.That Jupiter is about to conjunct with Neptune in the natal chart. So the bullishness at present may continue.This up move is also underlined by a conjunction between natal Uranus and transiting Mars in Capricorn.

During this up move we have corrections ( not down trends) coming up because of the following factors:

Venus-Uranus-Pluto translation

Mars square to Rahu-Ketu axis

Mercury square Saturn

Sun square to Saturn on January 31, 2013.

That is also the day transiting Jupiter becomes direct.

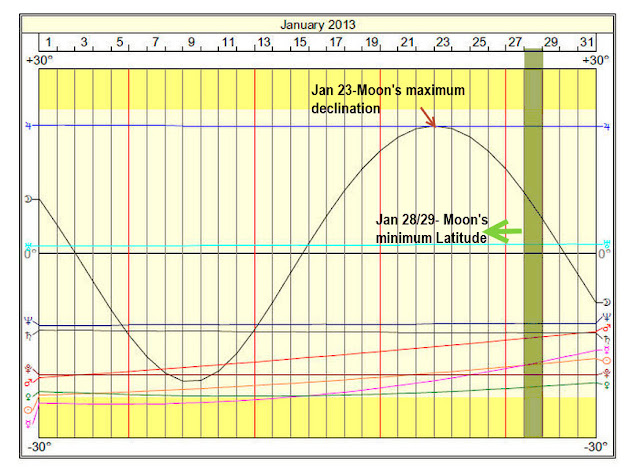

So the week beginning January Nifty may top out, possibly after RBI`s announcement. Most probably when Moon comes to Leo, on January 29, 2013,in the period between Full Moon and Third quarter Moon.

The next turns may happen on February 05, 2013, when Mars conjuncts Neptune.

me request, as usual, not to anticipate. Use regular indicators such as

moving averages and Bollinger Bands to enter and exit the market, with adequate

stop loss protection.

All the best for the forth coming week!

We were expecting a translation of Venus conjunction Pluto before which Venus had squared Pluto.

Just like in Technical Analysis and in Wave Theory, the major trend or cycle will dominate and influence the medium or shorter trends, always. This is very true in Financial Astrology as well.

So what was the mistake I did last week? It was not ascertaining the underlying major trends first before examining the medium or shorter trends.

I shall not make this mistake again.

What constitutes Long, Medium and Short term trends in Financial Astrology?

- Interactions between very slow and very distant moving planets constitute very long term trends. Eg: Uranus-Pluto-Neptune aspects to one another

- Interactions between distant moving planets constitute long term trends. Eg: Uranus-Pluto-Neptune aspects to Saturn,Jupiter, Rahu and Ketu or aspects involving only Saturn,Jupiter, Rahu and Ketu.Also stationary and retrograde stations of these distant planets are trend determinants.

- Interactions between medium distant moving planets constitute medium term trends. Eg: Uranus-Pluto-Neptune-Saturn-Jupiter,Rahu and Ketu aspects to Mars, Venus or Sun.Aspects between Mars, Sun and Venus to one another also can be medium term, provided there are other signatures nearby. Most often one or more of these aspects will be present in a cluster adding weightage to the moves.

- Mars, Sun,Venus and Mercury are fast moving planets and aspects and interactions among them leads to short term movements. Moon and the Ascendant influence very short term movements.

Coming back to Uranus- Venus -Pluto interactions, this medium term aspect can get postponed or diluted based on certain other long term aspects.Given below is one such example from the past.

Red line represents Uranus square Venus and Black line is Venus conjunct with Pluto.

Let us see the effect on the price chart...

So, the current Uranus-Venus- Pluto translation also has got the potential to get modified.

How do we expect it to pan out?

To understand that better, we need to see a couple of long term/ medium term effects in the offing..

So far our understanding is that, for a slightly longer term, Neptune and Jupiter will cause bullishness.

For the medium term, Uranus and Mars will cause bullishness but reversals in the short term also is on the cards.

Jupiter when it becomes direct will cause reversal of the current up moves.

One more time we look at this week`s charts...

Mars get into a square with Rahu and Ketu axis. And Sun will trine Jupiter.

So what we see is positive and negative forces acting alternatively and in tandem.

What do we conclude:

Astrologically, Nifty is bound to go up higher till possibly May, 2013, because of Jupiter in Taurus.That Jupiter is about to conjunct with Neptune in the natal chart. So the bullishness at present may continue.This up move is also underlined by a conjunction between natal Uranus and transiting Mars in Capricorn.

During this up move we have corrections ( not down trends) coming up because of the following factors:

Venus-Uranus-Pluto translation

Mars square to Rahu-Ketu axis

Mercury square Saturn

Sun square to Saturn on January 31, 2013.

That is also the day transiting Jupiter becomes direct.

So the week beginning January Nifty may top out, possibly after RBI`s announcement. Most probably when Moon comes to Leo, on January 29, 2013,in the period between Full Moon and Third quarter Moon.

The next turns may happen on February 05, 2013, when Mars conjuncts Neptune.

me request, as usual, not to anticipate. Use regular indicators such as

moving averages and Bollinger Bands to enter and exit the market, with adequate

stop loss protection.

All the best for the forth coming week!

Subscribe to:

Comments (Atom)